What to read about FTX

A Read Max Reader

What is this?

Read Max is a newsletter devoted to explaining the Weird Future, and the FTX fraud (and the crypto meltdown that’s accompanied it) deserve some explaining.

Over the last few weeks, as the story has developed, I’ve sent out some newsletters collecting and recommending smart, informative, or, at the very least, funny writing about FTX, SBF, Effective Altruism, and the other aspects of the meltdown.

On this page, I’ve collected all of that recommended reading into something between a syllabus and an explainer -- a starting place for anyone trying to learn more about the latest way that a ton of people have lost their money in crypto. This page was most recently updated on 12/1/2022. Click below to go straight to the latest information.

This is sort of an experiment, so I’m sharing it as a free post; If you find it useful (or, at least, sort of entertaining), please pass it on to people who you think would appreciate it.

This attempt at explaining Elon Musk’s whole deal to the general public took a lot of work, and was supported entirely by paid subscribers. If you want to see more free and public explainers like this, consider supporting us with a paid subscription to Read Max.

Background and dramatis personae

To follow the story, and to understand the nice narrative shape it’s taken, there are three people and three businesses it’s worth knowing about. The three businesses are:

FTX, the world’s second-largest cryptocurrency exchange (i.e., a platform on which people buy and sell cryptocurrency, and which makes its money by charging fees on those transactions).

Binance, the world’s largest cryptocurrency exchange.

Alameda Research, a trading firm tied to FTX.

The three people are:

Sam Bankman-Fried, or SBF, who founded Alameda in 2017 and FTX in 2019.

Changpeng Zhao, or CZ, who founded Binance in 2017.

Caroline Ellison, the CEO of Alameda and a friend and former romantic partner of SBF.

The most important dynamic to understand is the rivalry and enmity between CZ and SBF, whom Michael Lewis is apparently describing as “the Luke Skywalker and Darth Vader of crypto.” I would not use this analogy, personally; among other things CZ is not SBF’s father. This FT Alphaville post by Bryce Elder uses another, more contentious, analogy to help explain:

SBF is crypto establishment, and looking to legitimise the system by breaking bread with banks, regulators, politicians and journalists. Chinese-born CZ espouses the more decentralised, libertarian ethos of crypto. In cold war terms SBF is Stalin and CZ is Truman, which is an imperfect and uncomfortable analogy but probably better than the other way around.

“These guys resemble two war criminals with the blood and bone ash of millions staining the lapels of their suits” probably overstates it, but it’s a bit better than “one is the dark side and one is the light side.” The point is, these guys did not like each other; their businesses were competitors; and they represented at least facially different ideas of what crypto is and how it relates to the financial regime.

The other important thing to understand is that SBF became something like “the respectable face of crypto” for three reasons:

He was (sort of) willing to deal with the political and financial establishment on questions of regulation.

He was well-liked by crypto-skeptical and crypto-agnostic media figures because he was blunt and had a limited ideological attachment to cryptocurrency, which meant that when he went on the Bloomberg podcast Odd Lots in April of this year he more or less straightforwardly described one of the central money-making activities in crypto as a Ponzi scheme -- to the delight of the other people on the podcast -- instead of proselytizing about the transformative potential of Bitcoin.

He was a major philanthropist (and donor to the Democratic Party) of the “Effective Altruism” school of giving, more about which later.

Being “the respectable face of crypto” meant earning a lot of positive coverage from mainstream publications -- like the cover of Fortune magazine in August. But the exact things that made him likable, or tolerable, to politicians, journalists, regulators, and other people wary, skeptical, or sick of cryptocurrency -- his eagerness to play ball, his lack of zealotry, the sense that he was only in the business to make money for charity -- earned him a lot of enmity from elsewhere in the crypto universe. (Also, to be clear, many crypto skeptics felt SBF was exactly as annoying and full of shit as the laser-eyes freaks.)

Timelines and explainers

If you have only of the FTX meltdown in the context of it being the the product of an apparent philanthropic polycule, the really basic explanation for what seems to have happened, based on the information available to us so far, is that Alameda Research lost a ton of money on some bad trades and SBF/FTX secretly bailed the firm out with customer deposits. The narratively important part of the story is that this (incident of what has so far assumed to have been) fraud was uncovered after CZ sent FTX into crisis by dumping his significant share of the company’s native token, FTT, on the open market; he then verbally agreed to buy FTX to rescue out, only to renege when he took a look at FTX’s books and realized that the company’s assets were the equivalent of a lot of little pieces of paper with Sam Bankman-Fried’s face on them and the word SBFBUX. (Matt Levine’s cursory reading of the leaked balance sheet is something to behold.)

If you want to get into more detail, maybe the definitive narrative rendering of the FTX story so far comes, unsurprisingly if you know anything about the cryptocurrency space, not from a journalist with a name like “Gary” or whatever, but a person with the Twitter handle “@0xfbifemboy.” The piece is about 20 percent nerdier than I am fully able to understand, and about 40 percent too irresponsibly gossipy, which is a way of saying that it is exactly the kind of thing I hope to read every time I look at internet. Read it here.

For slightly more legible-to-outsiders reading, these explainers and timelines are all great as well:

“The Epic Collapse of Sam Bankman-Fried's FTX Exchange: A Crypto Markets Timeline,” (Sage D. Young, Bradley Keoun, Coindesk): A clear timeline of events, complete with explanatory links, from the outlet whose reporting lit the fuse.

“Mutual crypto-destruction assured” (Alexandra Scaggs, FT Alphaville): a short-but-sweet explainer from last Thursday.

“FTX files for bankruptcy, and the fallout begins. Who’s next?” (Amy Castor and David Gerard): a longer, chronological explainer from Sunday night.

Getting slightly more in depth

“Money, Credit, Trust, and FTX” (Bryne Hobart, the Diff): a long, clear piece assessing what happened at FTX, SBF’s motivations and strategies, and the consequences

“Exclusive: Behind FTX's fall, battling billionaires and a failed bid to save crypto” (Angus Berwick and Tom Wilson, Reuters): a well reported narrative feature on the background to the collapse and the events of last week

“The FTX-Alameda Nexus” (Frances Coppola): a nitty-gritty but very clear explanation of the exact mechanics by which FTX and Alameda got themselves into a position to collapse

“FTX Is Still Looking for Money” (Matt Levine, Bloomberg): a similarly approachable technical explanation of how the collapse itself might happen

An interesting thread from Dan Davies about what historical fraud FTX compares best to, and the ratioalizations of white-collar crime.

The fallout

Soon after it became clear that FTX’s reserves was just a box full of cobwebs and coupons, SBF stepped down, replaced by John Jay Ray III, the corporate restructuring expert who oversaw Enron in the aftermath of its public collapse, among others.1 The only single piece of writing I’ve liked more than @0xbifemboy’s summary is Ray’s bankruptcy filing. You can read the filing in full as a PDF here, but there are good summaries of the contents by Amy Castor and David Gerard at Attack of the 50-Foot Blockchain and Tracy Alloway at Bloomberg. This is probably the best bit:

The FTX Group received audit opinions on consolidated financial statements for two of the Silos – the WRS Silo and the Dotcom Silo – for the period ended December 31, 2021. The audit firm for the WRS Silo, Armanino LLP, was a firm with which I am professionally familiar. The audit firm for the Dotcom Silo was Prager Metis, a firm with which I am not familiar and whose website indicates that they are the “first-ever CPA firm to officially open its Metaverse headquarters in the metaverse platform Decentraland.” I have substantial concerns as to the information presented in these audited financial statements, especially with respect to the Dotcom Silo.

I also recommend Matt Levine’s newsletter, which narrates the filing quite effectively:

Imagine being the new CEO of a giant investing firm, and coming in to work your first day and asking your employees: “So, what investments have we invested in?” And they answer: “I don’t know, why don’t you Google it, maybe there are some newspaper articles about the investments we made.” “Reviewing various third-party sources to locate investments”! FTX/Alameda made investments and didn’t write them down, but maybe somebody else kept track of what they own. What.

So what happens next? In the short term, volatility. Smaller funds and platforms are revealing their exposure or feeling the heat. SBF himself might well face criminal charges. In the longer term, Bloomberg’s Joe Wiesenthal suggests that the FTX collapse marks the end of institutional dalliance with crypt, and that for architectural-philosophical reasons,

New York magazine’s big FTX package contains a pretty wrenching story by John Herrman about the Telegram group chats populated with FTX victims:

The perception that FTX was unusually safe because of its links to the U.S. was pervasive among locked-out customers. Adrian, a photographer in Berlin with his “first ever” savings trapped in FTX, assumed the exchange would have been heavily regulated. It got his attention in the first place with an ad starring Larry David. “The first time I have something and I lost it,” he tells me in a Zoom call. “I love Larry David. I can’t believe this.” […]

The anonymous organizers of FTX Affected Members are asking for names to add to a list that, they say, could one day be presented in bankruptcy court by an American law firm. It’s a long-shot strategy, they know, and organized on a shoestring; one the group’s most active administrators is helping run the group from a gas station in Ukraine, while his home is without electricity. “We are in a bad situation,” he told me. “FTX ripped us.”

Would better regulation of crypto have prevented this? Maybe? Joe Weisenthal argues that regulation (of which CZ is now suggesting he’s in favor) is going to be very difficult to accomplish for philosophical-architectural reasons:

And so any given coin that's held at a regulated entity is essentially governed by two different regulatory entities: the law and the chain.

We saw this vividly on Friday night, when there were hundreds of millions in unauthorized crypto withdrawals from FTX just hours after the company filed for bankruptcy.

Here you have a Chapter 11 bankruptcy, which prescribes rules about who can do what with a company's assets while it goes through a legal restructuring. But then you have someone with access to the corporate's wallets that can just ignore those rules entirely and operate by a separate set of rules: Those of the blockchain. The chain doesn't know anything about Chapter 11. To the chain, those were just normal, rule-abiding transactions.

And, frankly, I found pretty convincing this anti-crypto-regulation FT Alphaville column, which argues that regulation would likely entwine the crypto economy and the financial economy on a systemic level, worsening risk and undermining consumer protections at the much bigger traditional institutions:

Ironically, however, attempts to create a separate structure for regulating and supervising crypto will just make the financial system less, not more, safe. This is true for two reasons. First, it will encourage banks both to purchase crypto assets and to lend against them as collateral, making the banking system vulnerable to plunging market values. In contrast, even the ongoing collapse of crypto values and institutions has had virtually no impact on the wellbeing of the traditional financial markets and firms.

Second, new rules would lead to a migration of financial activity from traditional finance to the still less regulated, but newly sanctioned, crypto world. Both crypto and traditional finance are simply combinations of a database and computer code. It would be straightforward for a group of technicians to convert any set of conditional cash flows from one into the other. For example, imagine someone choosing to issue claims on their firm as a crypto token rather than as conventional equity to take advantage of looser rules for disclosure, accounting, custody, and the like.

Laser eyes watch

FTX pitchman Tom Brady’s Twitter PFP no longer has laser eyes.

Effective altruism

SBF, you’ll remember, was particularly famous (and socially tolerated outside the crypto circus) because of his philanthropic and political-donation activity, and in particular because of SBF’s longtime interest in effective altruism, a utilitarian philosophy of charity that (at best) emphasizes rigor, reason, and evidence in choosing where and how to give money, and (at worst) involves spinning out and putting resources toward achieving or avoiding elaborate, bizarre fantasies about the future. (Here’s a long (sympathetic) piece about effective altruism from Vox in August, in which SBF, a partial funder of the Vox vertical on which the article appears, features prominently.)

Because SBF was such a prominent figure in the effective altruism movement, and because, we might speculate, the fraud perpetrated by FTX could have been justified on utilitarian grounds, effective altruism is not having a great week, in whatever sense schools of philosophy can have good or bad weeks. Here’s prominent effective altruist philosopher William MacAskill, who worked with SBF, attempting to grapple with the revelations.

In terms of SBF’s other activity, the Financial Times has a good, critical piece on the effects of SBF’s sudden de-billionairization on the political causes he supports, complete with a graphic showing his donation activity, and Gabriel Debenedetti has some more details at New York.

The gossip

The polycule rumor

“Bankman-Fried’s Cabal of Roommates in the Bahamas Ran His Crypto Empire – and Dated. Other Employees Have Lots of Questions,” Tracy Wang, Coindesk:

Many are former co-workers from quantitative trading firm Jane Street, others he met at the Massachusetts Institute of Technology, his alma mater. All 10 are, or used to be, paired up in romantic relationships with each other. That includes Alameda CEO Caroline Ellison, whose firm played a central role in the company's collapse – and who, at times, has dated Bankman-Fried, according to people familiar with the matter.

Hmm. A polycule, or just 10 friends in their 20s? FTX’s in-house “performance coach” denied any such thing in a Times interview:

Details about the romantic pairings reported by CoinDesk last week led some gossips on Twitter to dub FTX a “polycule,” a term for a web of non-monogamous relationships.

But Dr. Lerner rejected that idea, saying the company’s culture was far from orgiastic.

“It’s a pretty tame place,” Dr. Lerner said. “The higher-ups, they mostly played chess and board games. There was no partying. They were undersexed, if anything.”

Ongoing Twitter gossip

The main channel for gossip about FTX and Alameda right now -- unfiltered, semi-reliable, but extremely juicy -- is the Twitter account @AutismCapital.

The stimulants

Among the most prevalent rumors is the suggestion that SBF and other FTX employees were using “designer stiumulants”:

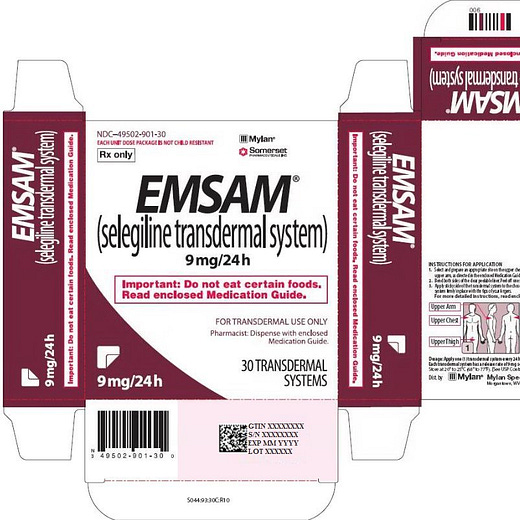

The “patch” is supposedly “Emsam (US brand name for selegiline), a MAO-B inhibitor used to treat Parkinson’s which increases levels of dopamine in the brain”; @AutismCapital found a photograph of SBF with an open box of what looked like Emsam on his desk:

@0xbifemboy insists that “it seems very likely that SBF’s propensity to take extreme levels of risk was elevated to preternaturally high levels via heavy, habitual usage of amphetamines and selegiline, causing him to rationalize nonsensical strategies as optimal via convoluted ‘linear wealth utility’ reasoning.” (Put another way: the Emsam made him do it!) I am personally pretty skeptical of that.

The in-house shrink, to be clear, denies it:

Since FTX’s collapse, rumors have spread on Twitter that many FTX employees took prescription stimulants, including Adderall, to enhance their productivity and work longer hours.

But Dr. Lerner disputed that characterization. He said that some FTX employees may have been given prescription medications to treat A.D.H.D., but that the “rate of A.D.H.D. in the company was in line with most tech companies.” He said that he wrote some prescriptions to FTX employees, but only those he treated as part of his personal practice.

Is SBF good at League of Legends?

“Sam Bankman-Fried is not very good at League of Legends,” Louis Ashworth, FT Alphaville:

There’s no clear pattern here: as you would expected for an appropriately low-ranked player, SBF maintained average-to-bad win ratios with his top champs (plant lady Zyra, crossbow-wielding witch-hunter Vayne and Egyptian-inspired god-dog Nasus).

Which bloggers did SBF like?

“Sam Bankman-Fried had plans for a Matt-and-Nate-heavy Substack competitor,” Max Tani and Liz Hoffman, Semafor:

It also means the end of Bankman-Fried’s plan for a Substack competitor populated by his favorite writers. The Substack writer Matt Yglesias confirmed that he had spoken to Bankman-Fried about the project, saying he was “flattered but not interested.” The 538 founder Nate Silver told Semafor that he spoke to an FTX executive about the project, and was similarly not interested. Other names Bankman-Fried floated included Bloomberg’s Matt Levine.

Caroline Ellison’s Tumblr

Caroline Ellison, SBF’s ex and the head of Alameda Research, had a Tumblr that was until recently still public:

For some fuller context on the scene Ellison was participating in, and the Type of Guy she was being, I recommend this short column by Allegra Rosenberg at Garbage Day:

Caroline’s alleged blog was pretty typical for a 2020s “tumblrina,” a specific type of girlie (gender neutral) who has stuck around on the platform long past its heyday and become comfortable within its more secluded and hermetic post-porn ban culture. Importantly, the blog was a Tumblr specifically, which means she was on there at least in part to participate in collective practices of cultural reception — a.k.a. fandom. […] Ellison has been labeled a “Harry Potter fangirl” because of comments made on the blog and elsewhere, though that's not quite right. She loved Harry Potter, but the blog has a lot of posts specifically about Harry Potter and the Methods of Rationality, Yudkowsky’s infamous plodding rewrite of the series which launched the entire genre of rationalfic.

I also liked Bridget Read’s short profile of Ellison in New York:

Ellison’s last tweets on November 6 chirpily disavowed that anything was really so wrong at Alameda. As one trader who met Ellison and made a killing in 2021 said, “Crypto really fucked with a lot of peoples’ perceptions of money. A lot of stuff doesn’t feel real. And if you add speed …” If SBF treated managing billions of investors’ money like a game, for Ellison it might have been a LARP, each risk an exercise in playing a character in a scenario, calculating how far to go and what behavior could be justified. Maybe that’s why she liked LARPing in the first place. As one Tumblr post said in 2018, the year Ellison took the job, “I guess it’s just fun to be a bad person for a few hours.”

Victory laps

The most important part of any news story is updating the ledger with the I-told-you-so’s and the in-retrospect,’s.

Dirty Bubble Media, a great investigative crypto newsletter of which I understand about 40 percent total, was asking “Is Alameda Capital Insolvent?” on November 4.

I liked Ed Zitron’s end-zone dance newsletter from last week, which begins “When I made my prediction on August 9, I did not expect to be completely right that ‘SBF’s money is like 400 different loans.’”

On the other end of the spectrum is Matt Yglesias, who just a week after castigating the New York Times for declining to cover the tech industry with the requisite level of “awe at progress and potential,” has a reminder of why aggressive and oppositional journalism about the rich is often better than the alternative. (In fairness, Yglesias did attempt to grapple with the story on his newsletter.)

But no one probably feels sillier this week than the journalist Adam Fisher, who wrote what feels like a 40,000-word, seemingly entirely unedited profile of SBF for Sequoia Capital’s editorial arm, which was subsequently removed from the Sequoia site. (Brad Stone has a good column about this.)

On the other hand without Fisher’s work we wouldn’t also have passages like this:

“Oh, yeah?” says SBF. “I would never read a book.”

I’m not sure what to say. I’ve read a book a week for my entire adult life and have written three of my own.

“I’m very skeptical of books. I don’t want to say no book is ever worth reading, but I actually do believe something pretty close to that,” explains SBF. “I think, if you wrote a book, you fucked up, and it should have been a six-paragraph blog post.”

SBF’s Defense

Since the FTX empire first began to crumble, SBF has been attempting to -- variously -- apologize, defend himself, and account for his actions. (It might be surprising to you that the child of two lawyers would be talking so loudly and publicly, making factual claims, admitting various levels of guitly, etc. about the question of his culpability in fraud! On the contrary I think it’s precisely because he is the child of two lawyers that he has decided not to listen to any lawyers in this case.) While most of these defenses have occurred in Twitter threads, on Wednesday (November 30) SBF appeared as part of The New York Times Dealbook Summit, and was interviewed, live, by Andrew Ross Sorkin. The Times has a transcript of the interview; it contains lots of em-dashes, like so:

SORKIN: How concerned are you about criminal liability at this point?

BANKMAN-FRIED: I don’t think that — obviously, I don’t personally think that I have — I think the real answer is it’s not — it sounds weird to say it, but I think the real answer is it’s not what I’m focusing on. It’s — there’s going to be a time and a place for me to think about myself and my own future. But I don’t think this is it.

Right now, look, I've had a bad month. This has not been a fun month for me. But that’s not what matters here. What matters here is the millions of customers. What matters here is all the stakeholders in FTX who got hurt and trying to do everything to help them out. As long as that’s the case, I don’t think that what happens to me is the important part of that, and I don’t think that’s what it makes sense for me to be focusing on.

As it turns out, SBF had already done an interview with Intel’s Jen Wieczner two weeks earlier, which he hilariously embargoed until after the Dealbook appearance:

Couldn’t you have hired an accountant?

We should have. We should have had multiple people thinking through this. That should have happened. It would have helped a lot.And a board?

Well, we had lots of boards. I mean we have lots of entities, regulated in lots of jurisdictions — we had lots of boards of directors of various entities, including the advisory board with a number of people on it that met every couple months and lots of other boards that met more frequently. I think the problem is that the boards didn’t generally focus as much on the— it was more of a high-level focus than a low-level focus.

Sounds like the problem is maybe too many boards?

SBF’s defense, based on the Intel interview, comes down to something like:

I wasn’t involved at Alameda (it was Caroline’s fault)

Everything would have been fine if we hadn’t allowed one customer to take a too-large margin position

But of course, (1) is demonstrably untrue, and (2) is -- as Dan Davies points out -- not actually a defense:

It’s hard not to agree with this further point from Davies:

I would strongly urge any powerful Hollywood producers reading this post to hire me to write a treatment of the FTX story, or perhaps a thinly fictionalized version thereof, told from the point of view of John Jay Ray III, a man about whom I know very little but whom I suspect is quite interesting. I’m thinking something halogencore here -- a Michael Clayton/Margin Call-type thing that’s part forensic-accounting mystery, part boardroom drama, part legal thriller, part narrative of a vibe shift. Imagine the opening scene: Ray (or his fictionalized stand-in), a world-weary backroom operator, receiving a mysterious call at 4 a.m. in a dark, well-appointed bedroom, and agreeing to fly to the Bahamas that day to take over a collapsing crypto enterprise. This is like a guaranteed-Oscar role; so agents of big-time actors please email me as well.